Helping You Navigate Reverse Mortgages with Confidence

At SimpleReverse Wholesale, we believe that education empowers success. Whether you're new to reverse mortgages or looking to deepen your expertise, this resource center is your one-stop shop for understanding the products, process, and potential of reverse lending.

>> Loan resources

We don’t want you—or your clients—feeling lost when it comes to navigating reverse mortgages. That’s why we shine a light on the process, offering clear guidance and personalized solutions every step of the way.

Whether you're helping a senior homeowner tap into their equity, plan for retirement, or simply gain financial peace of mind, our mission is to empower you with the tools, knowledge, and support you need to guide them forward—confidently and clearly.

Available Downloads

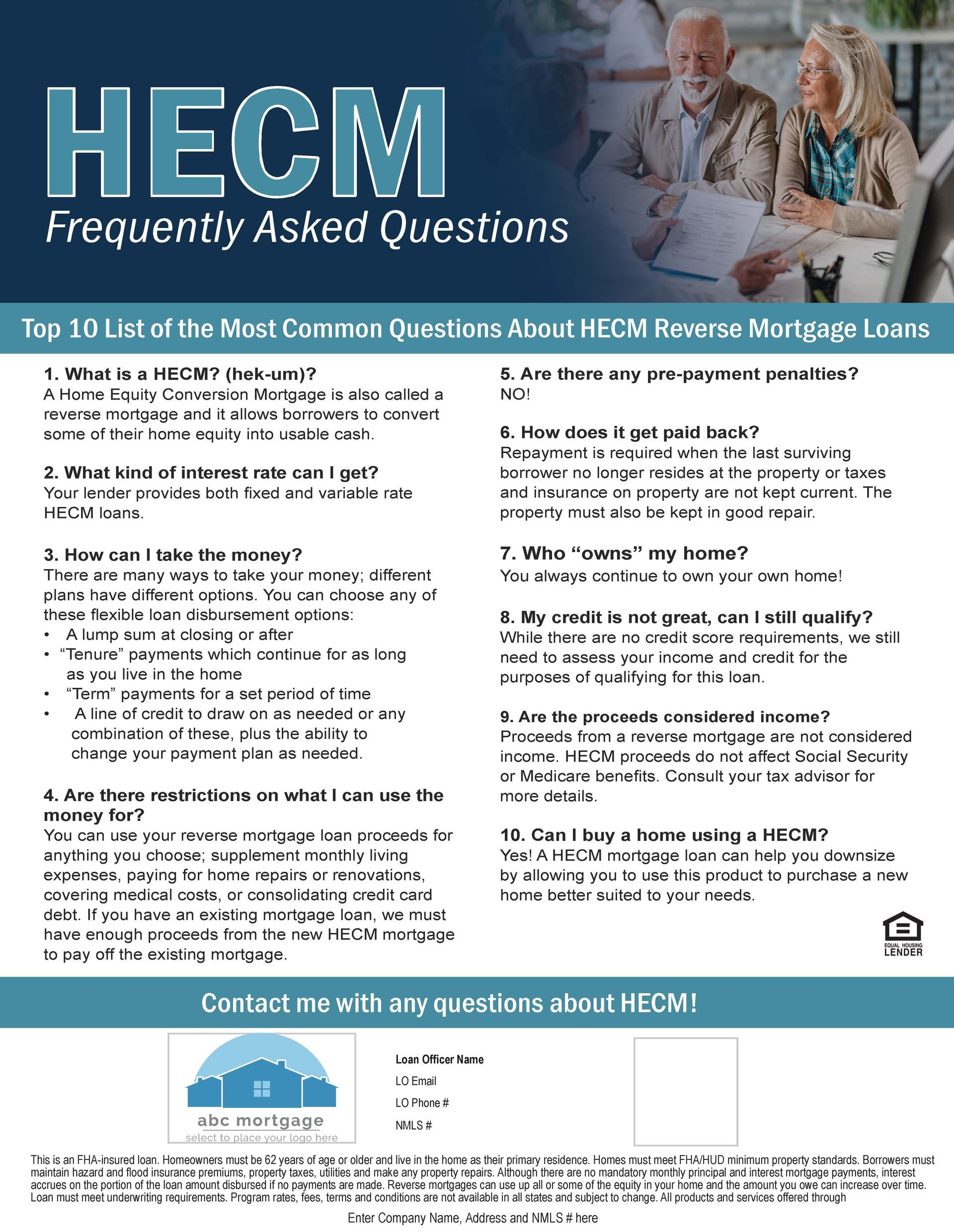

> What Is a Reverse Mortgage?

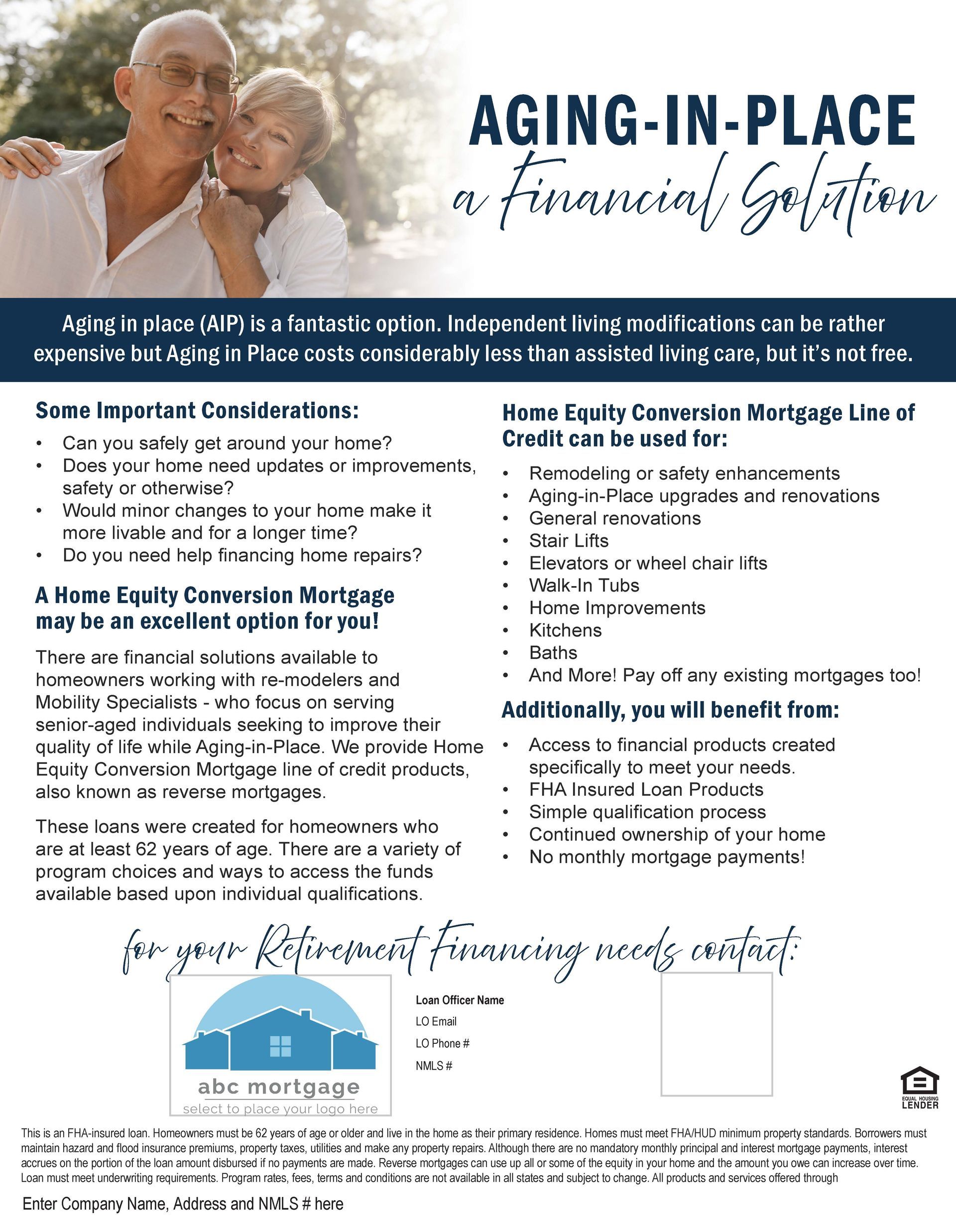

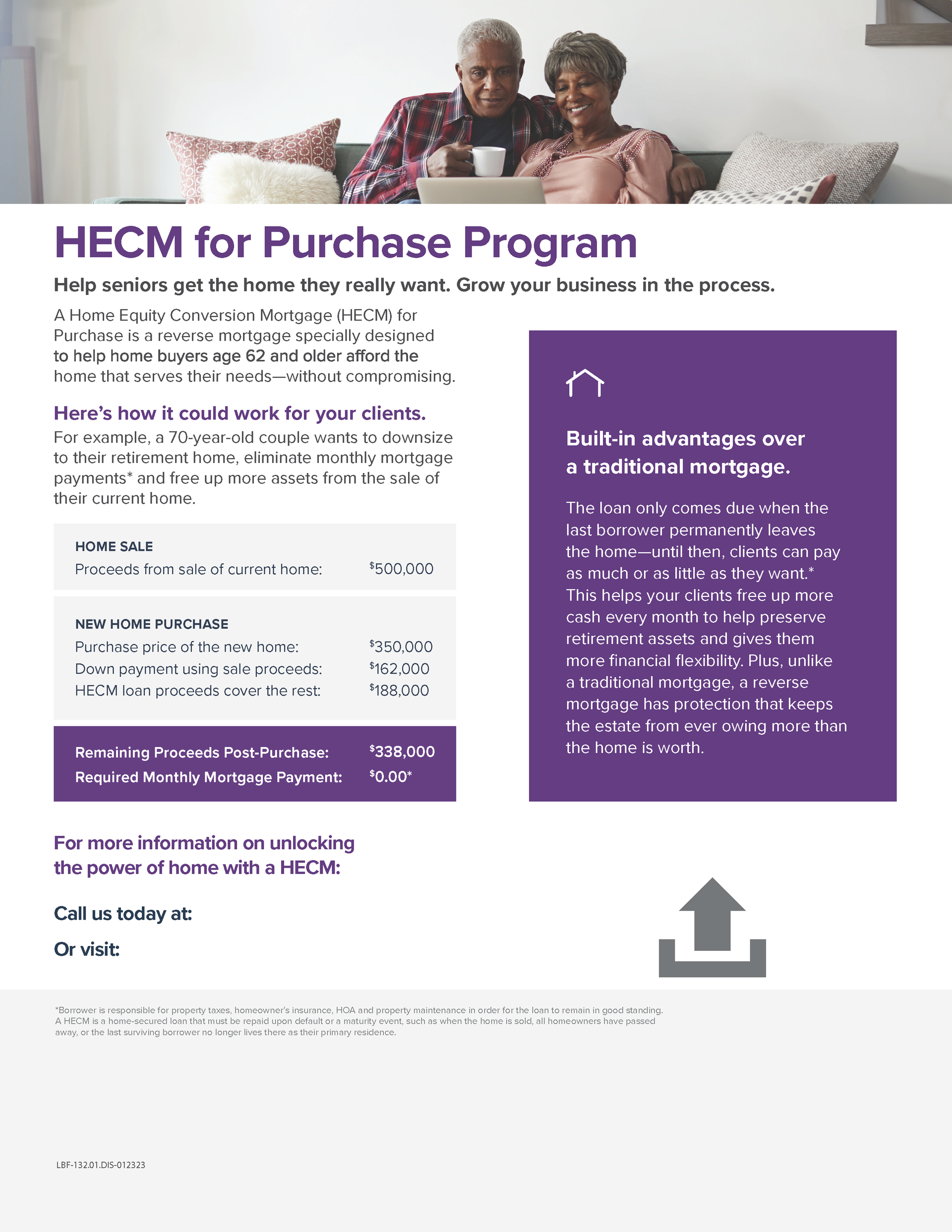

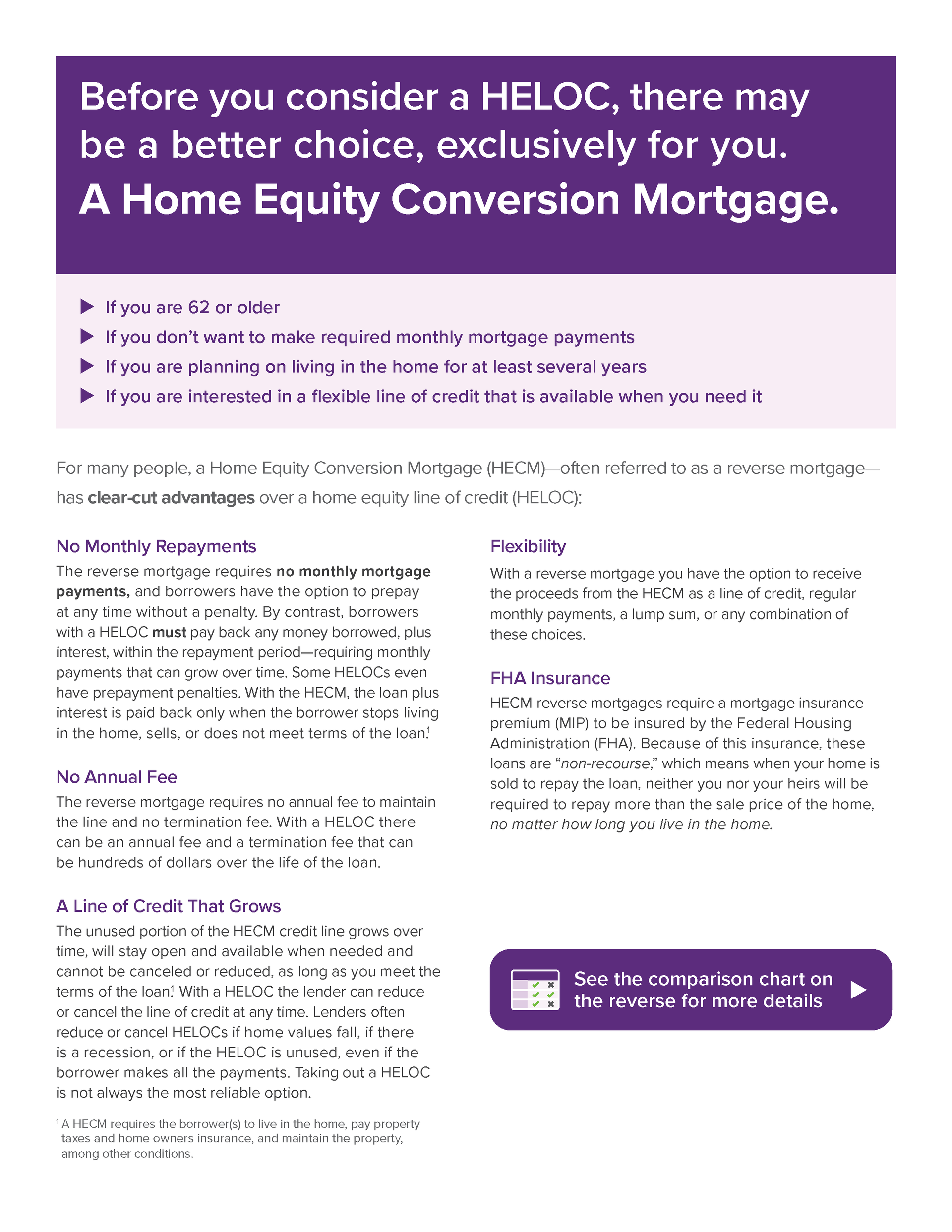

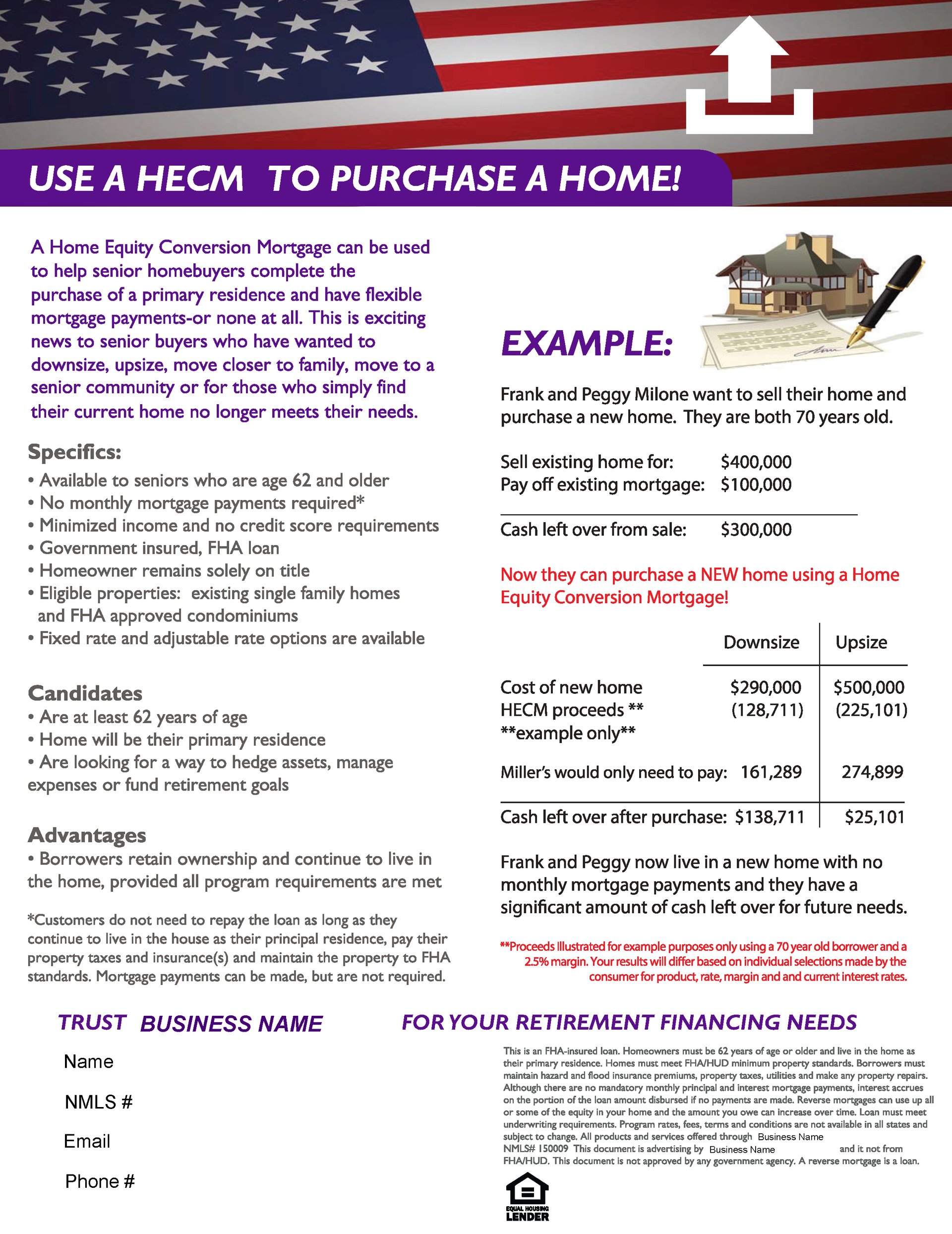

A reverse mortgage is a specialized loan that allows homeowners aged 62 and older to convert part of their home equity into tax-free funds—without having to sell the home, give up ownership, or take on monthly mortgage payments.

We offer Home Equity Conversion Mortgages (HECMs), the most common type of reverse mortgage, insured by the FHA.

Key Benefits for Borrowers:

- No monthly mortgage payments required

- Borrowers retain full homeownership

- Funds can be used for any purpose—retirement, debt consolidation, home improvements, and more

- Flexible disbursement options (lump sum, line of credit, or monthly payouts)

- Non-recourse loan: borrowers never owe more than the home’s value

> Reverse Mortgage Eligibility & Requirements

To help your clients qualify, here are the basic requirements:

- At least one borrower must be 62 or older

- The home must be the primary residence

- The property must be a single-family home, FHA-approved condo, or multi-unit (up to 4 units)

- Borrowers must maintain the home, pay property taxes and insurance

- Financial assessment required to ensure long-term affordability

> The Reverse Mortgage Process

We make the process simple, but here's a quick overview:

- Initial Consultation – Educate the borrower and discuss their goals

- Counseling Session – Required HUD-approved reverse mortgage counseling

- Application & Disclosures – Submit paperwork and review key docs

- Appraisal & Underwriting – Property is appraised, file is reviewed

- Closing & Disbursement – Funds are released based on the selected payout option

- Ongoing Support – Borrower stays in the home, maintaining it and staying current on taxes/insurance

>> We’re Here to Help

Not sure if a client qualifies? Need help structuring a reverse loan?

We’re more than a lender—we’re your reverse mortgage partner. Our seasoned Account Executives and support team are here to walk you through any scenario.